Spanish austerity programme is turning self-defeating

Yet during the last years of the Socialist Party (PSOE) government in Spain, Popular Party (PP) had a very clear idea of which should be the main steps that the country should follow to regain the growth path: A deep programme of structural reforms combined with a tight fiscal consolidation effort to cope with the intermediate fiscal deficit objectives compromised with Brussels.

To the eyes of PP leaders and economic policy strategists, the fulfilment of the different intermediate objectives concerning fiscal deficit would return investors’ confidence in Spanish economic fundamentals and growth potential, even if consolidation programme could cause job destruction during its first year of implementation.

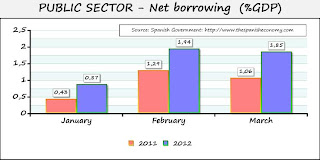

However, austerity programme is not showing any signs of success neither in the longer terms perspectives (Spanish economic prospects remain gloomy in the years to come) nor, and that is maybe the scariest part, even in the short-run, since Spanish fiscal position continues deteriorating.

Therefore it may look paradoxical, but austerity is defeating itself and its turning into a sort of lupus for Spanish fiscal consolidation also in the short term.

According to the data provided by Spanish government, even though public receipts have increased by more than 1,1 billion EUR (4%), the aggregate public expenditure has increased by more than 4,7 billion EUR increasing the fiscal deficit in almost a 40% with respect to the same month in the previous year.

As per some estimates of senior public officials in the Ministry of Finance, the expected loss in personal tax receipts may reach 2 billion EUR. These calculations are based on the 750 thousand extra unemployed forecasted until the end of this year and it does not take into account the unemployment insurance that should be paid to these additional unemployed, so fiscal impact would be considerably worse than this figure.

Additionally, this rapid deterioration in current levels of activity is also deeply affecting the quality of loan portfolio held by the Spanish banking sector, and subsequently to the level of provisions on bad loans. According to the estimates of the last “Financial Stability report” for 2011, that has been recently published by the National Bank of Spain, the rate of troubled assets could reached 60% of the current bank real estate loan portfolio (approximately 184 billion EUR).

These rapid levels of deterioration will reduce even more:

- The existing levels of funding available for the companies (with the subsequent cost in terms of shrinking even more current levels of activity)

- The actual demand of sovereign debt from the national banking sector (with the consequent increase of the interest rates paid by Spanish government)

In this bearish picture, the role of hedge funds and other similar actors with market power can only make the situation worse, triggering overshooting effects by taking short positions in operations in the sovereign Credit Default Swaps (CDS) market.

All in all, if

- all the efforts made by the current austerity programme cannot even ensure that short-term fiscal position will not deteriorate quickly and

- this fact is going to be used by the big players in the financial markets to make short-term profits on the account of Spanish funding costs

then it seems that maybe it is the right moment for Brussels to start reconsidering a reschedule in the fiscal consolidation path for troubled countries in the EU. At the same time, it might be essential to resume quantitative easing plans for the European Central Bank (ECB) as this is the best proven available option to deter big players in the financial markets from betting against sovereign debt markets.

If the willingness to undertake these actions does not come from the European institutions, maybe it is time to start disobeying the austerity mantra, at least until the structural reforms that are being implemented are fully in force. After all, the treatment is getting the patient worse, and, so far, Brussels has never been too harsh with naughty countries.

No hay comentarios:

Publicar un comentario